If you’re searching for commercial property for sale in Delhi, this article will provide you with a comprehensive guide. Delhi is one of India’s leading business centers and offers great opportunities to investors looking for commercial property for sale offers high rental returns and growth potential, whether you are interested in retail outlets, office space, or industrial properties. This guide will tell you everything you need about investing in Delhi’s market for commercial properties, what to look out for before purchasing, and how to make a decision that is aligned with your investment goals.

Why Choose Commercial Property for Sale in Delhi?

Delhi is India’s largest economic and business center. commercial property for sale in Delhi is a good investment for a number of reasons.

- High demand and economic growth — The commercial market in Delhi is expanding with an increase in businesses, startups, offices, and retail spaces in the NCR region.

- Better rental yields than residential properties — Commercial properties typically offer higher rental yields, with returns often ranging between 6–10% annually, compared to the 2–4% residential properties provide.

- Diverse property options — There are a wide variety of commercial properties available, from retail spaces and offices to coworking spaces and warehouses.

- Potential for appreciation — Properties located in high-demand areas tend to appreciate quickly, especially in zones of rapid urbanization and business growth.

For these reasons, seeking commercial property for sale in Delhi offers an excellent opportunity for investors looking for rental income or capital appreciation in the medium to long term.

Prime Locations for Buying Commercial Property in Delhi

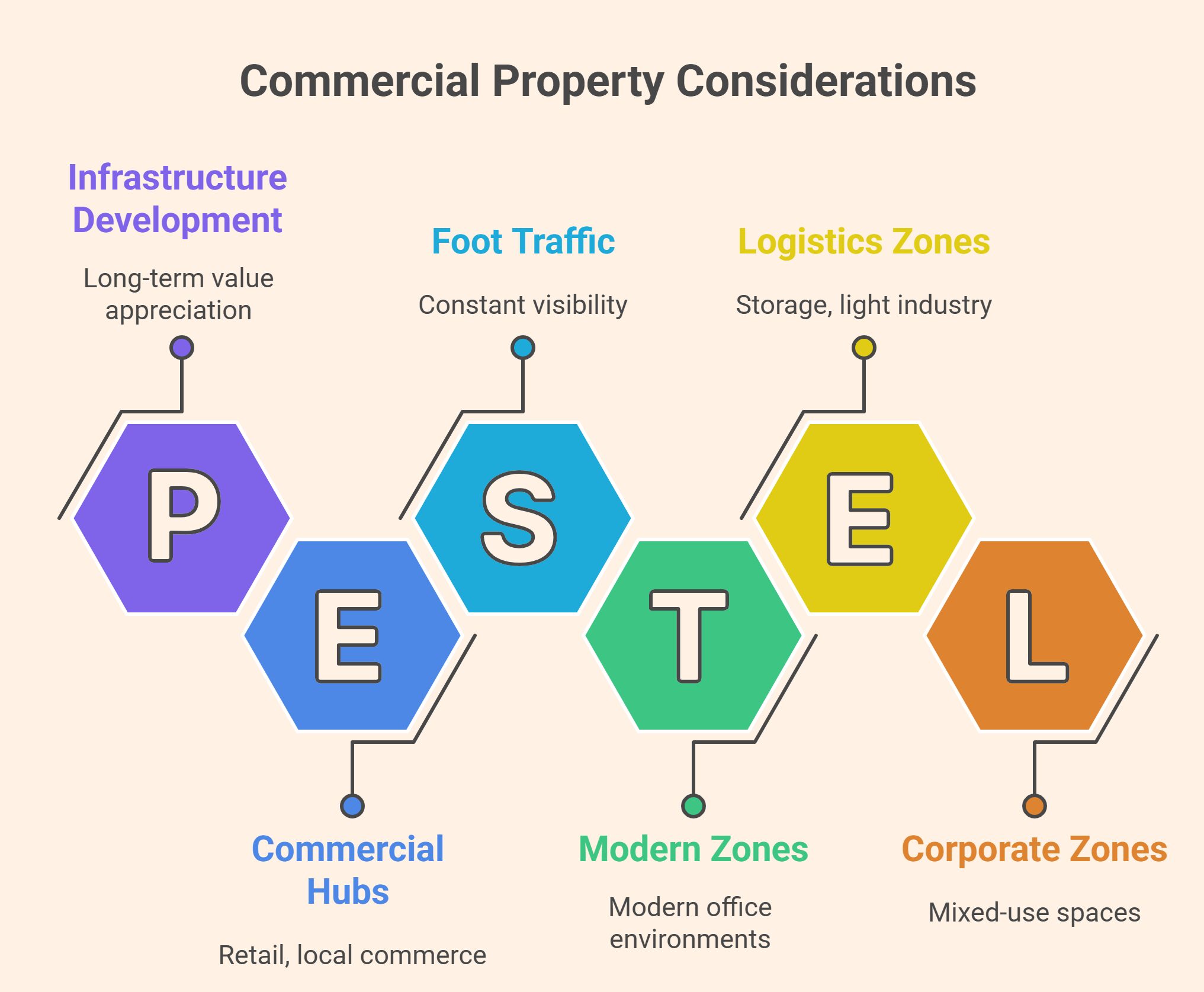

Not all areas in Delhi offer the same potential. Here’s a breakdown of some recommended areas to consider when buying commercial property:| Region/Location | Profile/Highlight | Why It’s Worth Considering |

| Traditional commercial hubs (markets, high-traffic streets) | Retail, local commerce | Offers visibility, constant foot traffic, ideal for retail and commerce |

| Modern corporate zones (offices, coworking spaces, new commercial developments) | Offices, coworking, mixed-use spaces | Meets demand for companies, startups, and modern office environments |

| Industrial/logistics zones | Warehouses, logistics, light industry | Suitable for logistics, storage, and companies needing larger spaces |

| Areas with infrastructure and connectivity (transportation, accessibility, amenities) | Any type of commercial property | Guarantees steady foot traffic, long-term value appreciation due to infrastructure development |

Example of Prominent Locations

- Central areas with heavy circulation — great for retail or storefronts.

- Modern corporate/commercial zones — ideal for offices, coworking spaces, or upscale commercial spaces.

- Regions with strong transport connections and infrastructure — essential for all types of businesses.

What to Consider Before Buying Commercial Property for Sale in Delhi

Purchasing commercial property for sale in Delhi requires careful evaluation. Here are the key factors to consider:

Location and accessibility

Location is a key factor in commercial property. Property located near transportation hubs, business centers or highways tends to do better on the market.

Infrastructure and Amenities

If the property has essential amenities, such as parking, safety, reliable electricity, adequate restrooms and transportation, you should check. These factors can have a significant impact on tenant satisfaction and the value of the property.

Demand for Property and Market Type

If you are looking to buy a certain type of space (office, retail space, coworking space or warehouse), consider whether the space is in demand. If a certain property type is not in demand, it may remain vacant and affect rental income as well as potential resale values.

Legality and Compliance

Verify that the property meets all legal and regulatory requirements. Verify the ownership papers, title, zoning laws and other legal requirements. Unregulated property could cause future problems.

Cost vs. yield and future returns

Compare the purchase price to potential rental income, or appreciation of property. A good commercial property will have a high return on investment, more so than a residential property, and a potential for appreciation over time.

Long-Term Growth Potential

Look at the future growth prospects of the area. Is the region undergoing development? Are there any upcoming infrastructure projects that could boost the property’s value? This is important when choosing commercial properties for long-term investment.

Advantages and Risks of Investing in Commercial Property for Sale in Delhi

✅ Advantages

- Higher rental yields compared to residential properties.

- Diverse property options, including retail spaces, offices, and warehouses, allowing flexibility in investment.

- Potential for rapid appreciation, especially in growing areas.

- Steady demand due to Delhi’s strong economic performance and urbanization.

⚠️ Risks and Considerations

- Location matters: Poor location or low visibility can significantly lower rental or resale value.

- Demand fluctuation: If there’s low demand for a particular type of property (office, retail, warehouse), it might remain vacant for a long time.

- Legal issues: Ensure that all documents are in place and the property complies with zoning and legal requirements.

- Higher maintenance costs: Commercial properties often incur higher maintenance costs, such as security, repairs, and utilities.

How to Choose the Ideal Commercial Property — Step by Step

- Set the goals you have set: Are looking to earn rental income, resell value or use the space to promote your company?

- Make sure you have a budget and anticipated results (e.g. rental yield or appreciation).

- Research the market: Learn about the market demand for commercial spaces in the region as well as the kind of business that operate there, and the growth prospects for the future.

- Verify accessibility, location, and amenities: Make sure that the property is easy to access and provides essential amenities like parking, transport accessibility and more.

- Verify the legal documentation: Ensure the property is in clear ownership with the proper zoning in place, as well as all permits required.

- Review market trends: Take a look at the recent price appreciation as well as supply and demand in the region.

- Compare property types: Consider if you need office space, retail space, coworking or warehouses.

- Factor in additional costs: Consider maintenance costs, taxes and other expenses that are ongoing.

Conclusion

Purchasing commercial property for sale in Delhi could be a good investment option, whether it’s for rental income or resales, or for business purposes. The combination of high demand, lucrative returns, and various kinds of properties make Delhi an ideal location for commercial real property. However, success is contingent upon careful research, an in-depth study of the place, demand and compliance with legal requirements.

If you’d like to create an evaluation checklist for the commercial property for sale in Delhi and cover everything from due diligence to research and analysis of financials. Would you like me make that checklist?

Frequently Asked Questions (FAQ)

Ques. What are the typical returns for commercial property for sale in Delhi?

Ans: Commercial properties in Delhi typically offer rental yields between 6% and 10%, which is higher than residential properties.

Ques. What type of commercial property is best to buy in Delhi?

Ans. It depends on your goal: retail spaces are good for high-traffic areas, offices or coworking spaces are ideal for corporate zones, and warehouses or logistics spaces are better for industrial areas with demand.

Ques. What should I check before buying a commercial property?

Ans. Check the location, accessibility, available amenities, market demand, property type, legal documentation, zoning laws, and potential for appreciation.

Ques. Is buying commercial property riskier than residential?

Ans. Yes — commercial properties have higher risks due to location, demand fluctuations, and the need for more legal and regulatory compliance. However, they also offer higher returns if managed properly.

Join The Discussion