Selling a property is a major financial decision, and understanding the property selling process in India is essential to avoid legal, tax, and pricing mistakes. Whether you are an individual owner, investor, or NRI, this detailed guide explains how to sell property in India smoothly, legally, and at the best possible price.

Introduction to Selling Property in India

The real estate market in India has become more transparent due to RERA, digitisation of land records, and online property portals. Today, selling real estate in India is faster and safer if you follow the correct legal steps and pricing strategy.

From valuation to registration, each stage plays a crucial role in ensuring a successful sale.

How to Sell Property in India – Step-by-Step Process

1. Property Valuation

Before you sell property in India, determine its correct market value based on:

- Location

- Property type

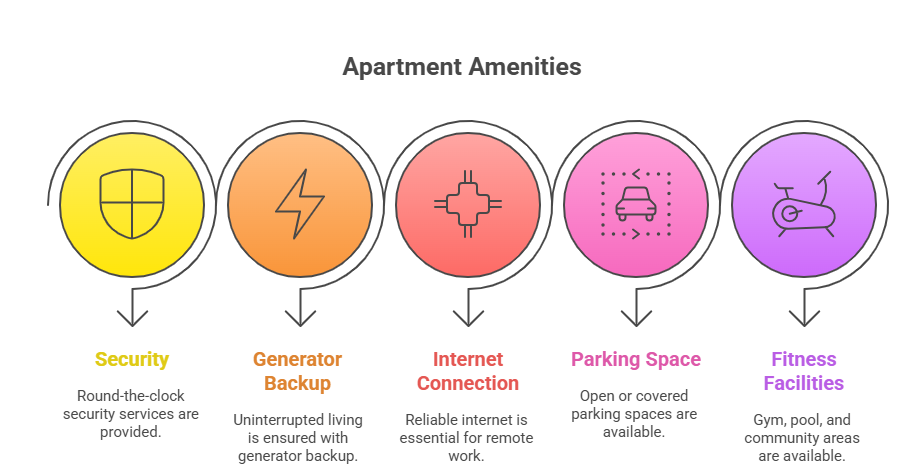

- Amenities

- Current market demand

You may consult a real estate expert or use online valuation tools.

2. Prepare Required Documents

Proper documentation is mandatory for selling property in India legally.

|

Required Document |

Purpose |

|

Sale Deed |

Proof of ownership |

|

Title Deed |

Ownership clarity |

|

Encumbrance Certificate |

Confirms no legal dues |

|

Property Tax Receipts |

Shows tax compliance |

|

Approved Building Plan |

Legal construction proof |

|

Occupancy Certificate |

Completion approval |

3. Marketing the Property

To attract genuine buyers:

- List on property portals

- Use professional photos

- Highlight location benefits

- Mention price transparently

This step is crucial when selling real estate in India without delays.

4. Negotiation & Agreement to Sell

Once a buyer is finalised:

- Negotiate price & payment terms

- Sign an Agreement to Sell

- Receive token amount (usually 10%)

This agreement legally binds both parties.

5. Property Registration

The final step in the property selling process in India includes:

- Payment of stamp duty & registration charges

- Signing the Sale Deed at the sub-registrar office

- Transfer of ownership

After registration, the buyer becomes the legal owner.

Click Here to Contact

Property Selling Process in India – Overview Table

Step | Description |

Valuation | Determine market price |

Documentation | Collect legal papers |

Marketing | List & promote property |

Agreement | Fix price & terms |

Registration | Legal ownership transfer |

Taxes Involved in Selling Property in India

When selling property in India, capital gains tax applies:

Type of Gain | Holding Period | Tax Rate |

Short-Term Capital Gain | Less than 2 years | As per income slab |

Long-Term Capital Gain | More than 2 years | 20% with indexation |

Tax planning is important to maximise profit.

4 Short Descriptions (Key Highlights)

- Selling property in India requires proper documentation, valuation, and legal compliance.

- Understanding the property selling process in India helps avoid disputes and delays.

- Correct pricing and marketing can help you sell property in India faster.

- Registration and tax compliance are mandatory while selling real estate in India.

Common Mistakes to Avoid While Selling Real Estate in India

- Incorrect property pricing

- Incomplete documentation

- Ignoring capital gains tax

- Not verifying buyer credentials

- Skipping legal consultation

Avoiding these mistakes ensures a smooth transaction.

Conclusion

Understanding how to sell property in India is essential for a profitable and stress-free transaction. By following the correct property selling process in India, maintaining legal transparency, and planning taxes wisely, you can successfully complete your property sale.

Read More: Property Tax Appeal Process Guide India

Read More: Property Transfer in India

FAQs – Selling Property in India

Q1. What is the legal process of selling property in India?

Ans. The property selling process in India includes valuation, documentation, agreement to sell, payment of stamp duty, and registration of the sale deed.

Q2. How to sell property in India without a broker?

Ans. You can list your property on online portals, market it digitally, negotiate directly with buyers, and consult a property lawyer for documentation.

Q3. What documents are required for selling property in India?

Ans. Key documents include Sale Deed, Title Deed, Encumbrance Certificate, tax receipts, and approved building plans.

Q4. Is capital gains tax mandatory when selling real estate in India?

Ans. Yes, capital gains tax is applicable based on the holding period and must be paid while selling real estate in India.

Join The Discussion