Paying Property Taxes is among the largest liabilities for home owners as well as investors from India. If you’ve got the proper information, you could be eligible for an Property Tax Deduction under the Income Tax Act and decrease your tax-deductible income. For instance, knowing about the significance of these deductions is vital for those who manage property taxes near Gurugram, Haryana, or taxes on property near Delhi which is where the municipal rates and rules are in place.

This guide will provide an explanation of the way Property Tax Deduction works, the different types of deductions that are offered and how online tools such as MCG property tax login online as well as MCG the property tax invoice download can ease tax administration.

What is Property Tax Deduction?

The Property Tax Deduction enables the property owner to deduct the amount of municipal Property Taxes paid from the gross annual value for the purpose of calculating income tax. This deduction reduces the taxable portion of rental income or notional income from self-occupied properties.

Key points about Property Tax Deduction:- Only applies to taxes actually paid, not just due amounts

- Applicable to both self-occupied and rented properties

- Can be claimed in any municipality, including property taxes near Gurugram, Haryana and property taxes near Delhi

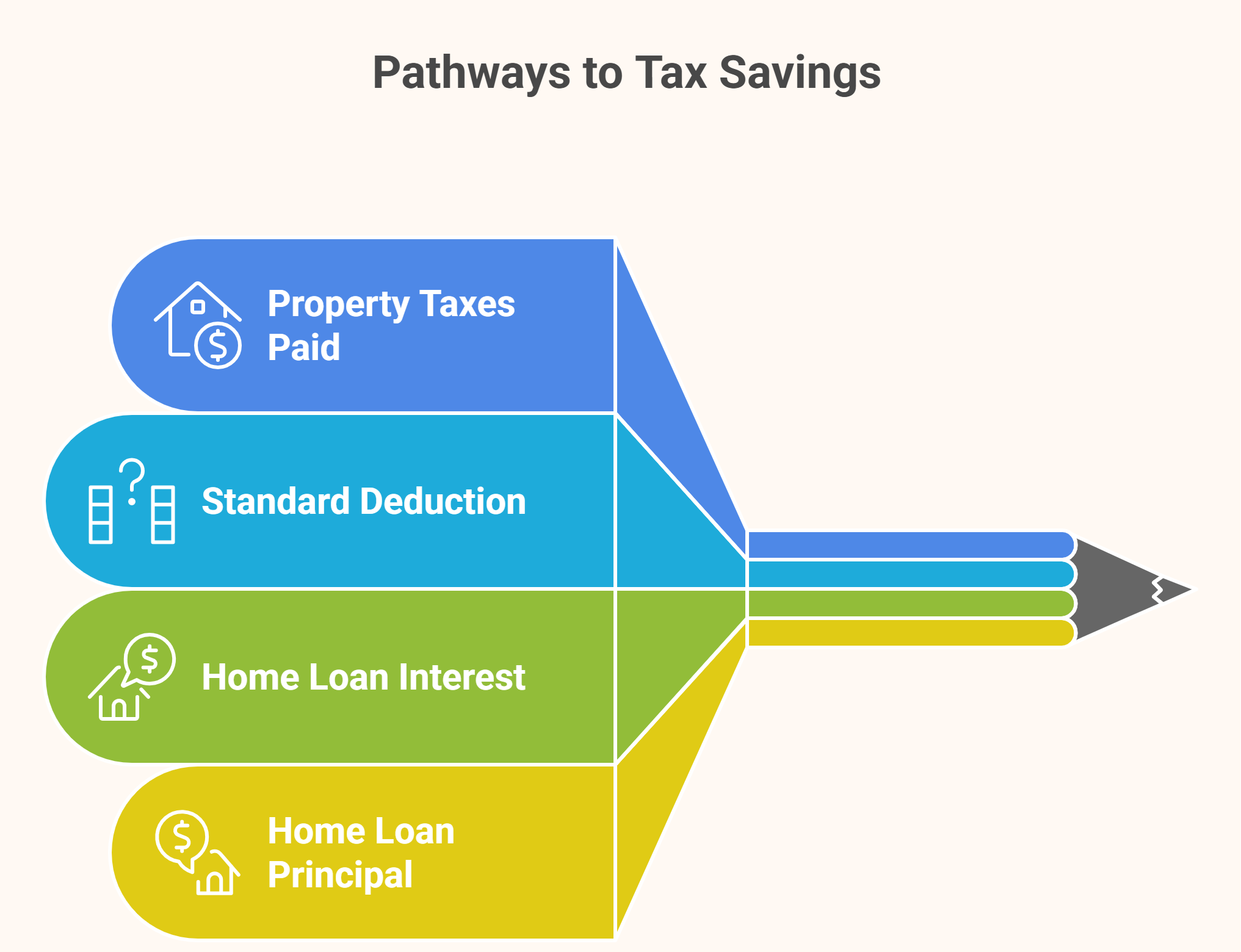

Types of Property Tax Deductions

1. Deduction for Property Taxes PaidAll municipal Property Taxes paid in a financial year can be deducted from your gross annual value. This reduces your taxable income from the property.

2. Standard Deduction on Net Annual ValueAfter subtracting Property Taxes, you can claim a standard deduction of 30% of the net annual value. This deduction accounts for repairs and maintenance costs without requiring proof of expenses.

3. Home Loan Interest Deduction For property owners with loans, interest paid on a home loan is deductible along with Property Tax Deduction benefits.| Property Type | Maximum Deduction Limit |

| Self-occupied | ₹2,00,000 per year |

| Rented property | No upper limit |

| Deduction Limit | Condition |

| Up to ₹1.5 lakh | Property must not be sold within 5 years |

How Property Tax Deduction Reduces Taxable Income

Step | Impact |

Gross Annual Value | Total rental income or notional income |

Less: Property Taxes | Lowers taxable base |

Net Annual Value | Reduced taxable income |

Less: Standard Deduction | Further savings |

Paying your Property Taxes on time is essential to claim the full deduction.

Managing Property Taxes Online

Digital tools make claiming Property Tax Deduction easier:

- Use MCG property tax online login to check dues and property details

- MCG property tax bill download provides official proof for tax filing

- Pay property taxes online to ensure timely payment

- Useful for properties under property taxes near Gurugram, Haryana and property taxes near Delhi

Eligibility and Conditions for Property Tax Deduction

Requirement | Detail |

Payment Status | Only paid Property Taxes are eligible |

Proof | Official receipt or online confirmation |

Ownership | Must be the registered property owner |

Financial Year | Deduction applies in the year of payment |

Conclusion

The claim of the Property Tax Deduction is a great option for investors and homeowners in India to lower their tax-deductible income. When you pay Property Taxes promptly, keeping precise records, and using electronic tools such as MCG Property Tax Online Login or MCG Property Tax Bill Download, homeowners are able to reduce their tax burden legally while still being legally compliant. Be aware of local laws for property taxes near Gurugram, Haryana and property taxes near Delhi makes sure you maximize the amount of deductions you receive each year.

Read More: Property Transfer in India

Read More: Property Registration Process in India

Frequently Asked Questions (FAQs)

1. What is a Property Tax Deduction?

A Property Tax Deduction allows property owners to subtract paid municipal taxes from gross annual value when calculating taxable income.

2. Can unpaid property taxes be deducted?

No, only Property Taxes actually paid during the financial year qualify.

3. How do I get proof for Property Tax Deduction?

You can use MCG property tax bill download or receipts obtained after you pay property taxes online.

4. Does this apply to Gurugram and Delhi properties?

Yes, deductions apply for property taxes near Gurugram, Haryana and property taxes near Delhi, subject to income tax rules.

Join The Discussion