Property tax is a mandatory levy imposed by municipal authorities on property owners. Sometimes, due to errors in valuation or classification, property owners may receive an inflated tax assessment. This property tax appeal process guide India explains when and how to appeal property tax assessment, the valid reasons to appeal property tax assessment, and how to achieve a successful property tax appeal.

Understanding Property Tax Assessment in India

Property tax assessment is the method used by local municipal bodies to calculate the annual tax payable on a property. The assessment is usually based on factors such as:

- Property size and location

- Type of property (residential, commercial, vacant land)

- Usage (self-occupied or rented)

- Construction type and age

- Guidance or circle rates

Errors in any of these factors can result in higher tax liability, making an appeal necessary.

Can You Appeal Property Tax Assessment?

A common question among property owners is: can you appeal property tax assessment?

Yes, property owners in India have the legal right to appeal if they believe the assessment is incorrect or unfair.

Municipal laws across states allow taxpayers to challenge assessments within a specified time limit, usually 15–30 days from receiving the assessment notice.

Should I Appeal Property Tax Assessment?

You may wonder, should I appeal property tax assessment? Filing an appeal is advisable if:

- The assessed value is significantly higher than similar properties

- The property details are incorrect

- You are paying more tax than legally required

- The property use has been wrongly classified

If your appeal is valid and supported by documents, it can reduce your tax burden significantly.

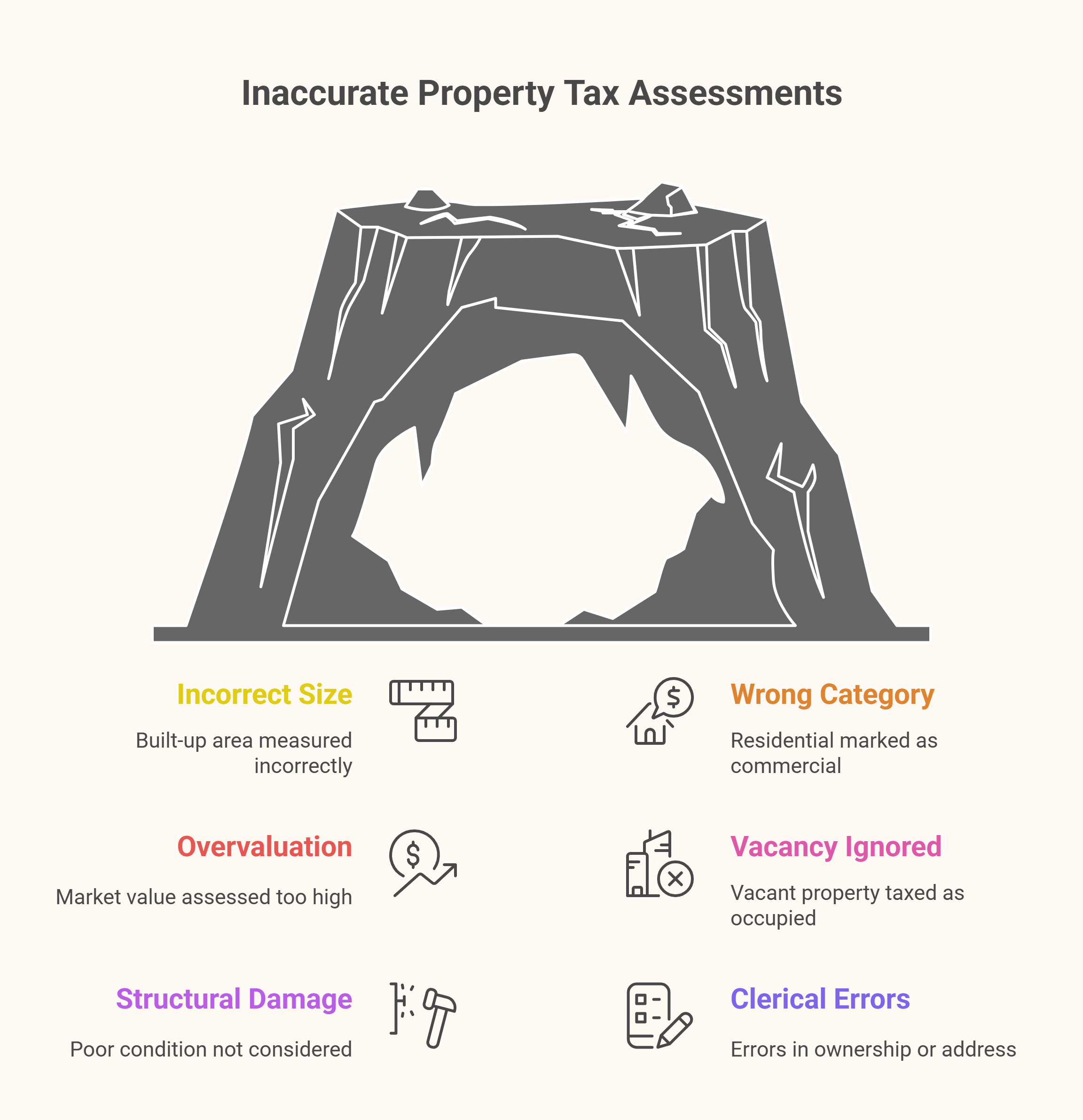

Reasons to Appeal Property Tax Assessment

Understanding the correct reasons to appeal property tax assessment improves your chances of success. Common reasons include:

- Incorrect built-up area calculation

- Wrong property classification (commercial instead of residential)

- Overvaluation compared to neighboring properties

- Property is vacant but assessed as occupied

- Structural damage or old construction not considered

- Errors in ownership or usage details

These reasons to appeal property tax assessment pdf are often listed in official municipal guidelines and appeal forms.

Valid Reasons for Property Tax Appeal

Reason | Explanation |

Incorrect Property Size | Built-up area measured incorrectly |

Wrong Usage Category | Residential marked as commercial |

Overvaluation | Market value assessed too high |

Vacancy Ignored | Vacant property taxed as occupied |

Structural Damage | Poor condition not considered |

Clerical Errors | Errors in ownership or address |

How to Appeal Property Tax Assessment in India

Knowing how to appeal property tax assessment is crucial for a smooth process. Below is a step-by-step guide:

Step 1: Review the Assessment Notice

Carefully check the tax notice for errors in area, usage, rate, or valuation.

Step 2: Collect Supporting Documents

Prepare documents such as:

- Sale deed or title deed

- Property tax receipts

- Building plan approval

- Photographs of property condition

- Comparable property tax records

Step 3: Draft the Appeal Application

You may submit a written appeal or online application depending on your municipality.

A property tax assessment appeal letter sample usually includes:

- Property details

- Assessment number

- Reasons for appeal

- Supporting evidence list

Step 4: Submit the Appeal

Submit the appeal within the prescribed deadline to the local municipal office or online portal.

Step 5: Attend the Hearing

Municipal authorities may schedule a hearing. Present your case clearly with evidence.

Step 6: Await the Decision

If approved, the revised tax demand will be issued. If rejected, you may escalate to a higher authority.

Property Tax Assessment Appeal Letter Sample (Format)

| Section | Details |

| Subject | Appeal Against Property Tax Assessment |

| Property Details | Address, assessment number |

| Reason for Appeal | Clear explanation of errors |

| Supporting Documents | List of attached proofs |

| Request | Reassessment and tax revision |

| Signature | Property owner’s signature |

This format is commonly accepted across Indian municipalities.

Tips for a Successful Property Tax Appeal

A successful property tax appeal depends on preparation and clarity. Follow these tips:

- File the appeal within the deadline

- Provide accurate documentary evidence

- Compare with similar nearby properties

- Be concise and factual in your appeal

- Attend hearings personally or through an authorized representative

Avoid emotional arguments and stick to legal and factual grounds.

Online vs Offline Property Tax Appeal Process

| Mode | Advantages | Limitations |

| Online Appeal | Convenient, faster processing | Limited document upload size |

| Offline Appeal | Personal interaction with officials | Time-consuming |

Most major cities in India now offer online appeal facilities.

Property Tax Appeal Process Guide India: Key Takeaways

- Property owners have a legal right to appeal assessments

- Valid reasons and documents are essential

- Appeals must be filed within a fixed time limit

- Proper drafting improves success chances

Understanding this property tax appeal process guide India helps homeowners avoid overpaying taxes and ensures fair property valuation.

Read More: Property Maintenance

Read More: Top Property Tax Saving Tips

Frequently Asked Questions (FAQ)

Ques. Can you appeal property tax assessment every year?

Ans. Yes, you can appeal whenever a new assessment or revision is issued if errors exist.

Ques. How long does the property tax appeal process take?

Ans. It usually takes 30 to 90 days, depending on the municipality and case complexity.

Ques. Is professional help required for property tax appeal?

Ans. Not mandatory, but a tax consultant or lawyer can help in complex or high-value cases.

Ques. What happens if my property tax appeal is rejected?

Ans. You can approach a higher appellate authority or tribunal as per municipal laws.

Join The Discussion